Retirement planning isn’t just about how much you’ve saved. It’s about whether your income can last as long as you do.

For Canadians without a large defined-benefit pension, life annuities are one of the few tools that can guarantee income no matter how long you live. They’re often misunderstood, sometimes dismissed, and frequently confused with investments.

This guide explains what life annuities really are, how they differ from CPP, and when guaranteed income matters most inside a smart, lifecycle-based retirement income plan.

What Is a Life Annuity?

A life annuity is a contract with an insurance company where you exchange a lump sum of savings for a guaranteed income stream that pays for as long as you’re alive.

Payments typically start immediately and continue:

→ Regardless of market performance

→ Regardless of interest rate changes

→ Regardless of how long you live

Once purchased, the payment amount is fixed (unless you explicitly choose inflation protection).

At its core, a life annuity converts part of your savings into something that behaves like a personal pension.

💡 Did You Know?

A life annuity is not an investment — it’s insurance against outliving your life expectancy.

When you buy a life annuity, you’re not trying to beat the market or maximize returns. You’re transferring longevity riskto an insurance company.

→ If you live longer than expected, the insurer pays you more than you contributed

→ If you pass away early, the insurer keeps the remaining value

Why Life Annuities Exist at All

Life annuities exist to solve one problem: longevity risk — the risk of outliving your money.

Retirees aren’t trying to plan income to a specific age. They’re trying to ensure a minimum level of income lasts forever.

That is exactly what a life annuity is designed to help with.

Are Life Annuities Indexed to Inflation?

Most life annuities in Canada are not indexed to inflation by default.

→ A standard life annuity pays a fixed dollar amount

→ That payment does not increase

→ Inflation gradually erodes purchasing power over time

Unlike CPP, Life Annuities Are Usually Fixed

Both CPP and life annuities provide lifetime income — but they behave very differently:

→ CPP payments increase each year with inflation

→ Most life annuities pay the same amount forever

Inflation-Indexed Life Annuities (Optional)

Some insurers offer inflation-indexed life annuities, but the trade-off is clear:

→ Lower starting income

→ Higher cost for long-term protection

Many retirees accept fixed payments because:

→ CPP and OAS already provide inflation-adjusted income

→ The annuity is designed to secure essential expenses

→ Investments from a portfolio remain the primary inflation hedge

A Practical Example: Life Annuity at Age 70

At age 70, imagine a retiree already receiving CPP and OAS, which provide inflation-indexed lifetime income.

Even with those benefits, there is often a gap between:

→ Guaranteed income received, and

→ The minimum income needed to cover essential expenses

The retiree allocates part of their savings to a life annuity.

What changes:

→ The annuity pays a fixed amount for as long as the retiree is alive

→ There is no end date

→ Market performance no longer affects that portion of income

→ Living longer increases the cumulative total amount received

This creates a permanent income floor that does not rely on portfolio withdrawals.

The Insurance Logic Behind Life Annuities

Life annuities work because insurers pool longevity risk across thousands of people:

→ Some annuitants pass away earlier than expected

→ Others live far longer than average

→ The pool allows payments to continue for life

This is the same principle that makes CPP work.

A life annuity doesn’t exist to predict your lifespan — it exists so you don’t have to predict when you will be gone.

Life Annuities and the Go-Go, Slow-Go, and No-Go Years

A common mistake is assuming the role of a life annuity is to cover your retirement income gap immediately.

That’s rarely the goal.

In reality, life annuities are most valuable later in retirement, when health, energy, and flexibility decline.

💡 Did You Know?

A life annuity is just a tool — not a philosophy, not a strategy, and not a verdict on your investing skill.

Like any tool:

→ It solves a specific problem (longevity risk)

→ It works best in a specific context (later retirement years)

→ It can be useful in small amounts — or not at all

Dismissing annuities outright is no different than dismissing bonds, cash, or insurance. Don’t confuse tool selection with belief.

Go-Go Years: Your Portfolio Does the Heavy Lifting

In the Go-Go years (early retirement):

→ Spending is higher

→ Travel, experiences, and flexibility matter most

→ Adaptability is a major advantage

During this phase:

→ Your investment portfolio does roughly 95% of the heavy lifting

→ Withdrawals are dynamic and responsive

→ Market volatility is manageable

Locking in too much guaranteed income too early can reduce optionality later on. Your portfolio net value and construction establishes all the boundaries for your portfolio here. Did you have enough money to retire? Did you plan a bucket strategy to minimize the impact of a bad year? Is the income capable of keeping up with inflation?

Your health and energy are going to drive how long you can spend at this level.

Slow-Go Years: Risk Tolerance Softens

In the Slow-Go years:

→ Spending becomes more predictable

→ Activity levels decline

→ Emotional tolerance for volatility decreases

This is often when retirees begin to layer in life annuities — not to replace the portfolio, but to reduce dependence on it.

No-Go Years: Where Life Annuities Earn Their Keep

In the No-Go years:

→ Health and mobility decline

→ Decision-making becomes harder

→ Market stress feels more threatening

This is where life annuities shine. Their purpose is not growth — it’s certainty.

Combined with CPP and OAS, a life annuity helps:

→ Close the income gap that matters most

→ Reduce reliance on portfolio withdrawals

→ Ensure essential expenses are covered with minimal effort

💡 Did You Know?

Many DIY retirees build retirement models that assume Go-Go spending, portfolio control, and flexibility will last forever.

To manage the fear of running out of money, these models often:

→ Rely almost entirely on portfolio withdrawals at every age

→ Assume constant decision-making ability and risk tolerance

→ Dismiss annuities as “bad investments” because they don’t maximize returns

What’s often overlooked is that life annuities aren’t designed for the Go-Go years at all — they’re designed for the No-Go years, when adaptability is lowest, and certainty matters most.

📚 ADDITION TO YOUR LIBRARY

A little more knowledge can add to your life journey.

DIE WITH ZERO

This book will change how you think about spending money in retirement!

It’s not an income strategy; it’s purely about capturing the intersection of money and health in order to maximize it!

Choosing When to Start a Life Annuity

One of the most important annuity decisions is when to start it.

There is no universal right age, but in practice, many life annuities are purchased around age 70 — and that’s driven by actuarial math.

Why Age 70 Is Common

Insurance companies price life annuities using average life expectancy.

For Canadians in their late 60s or early 70s, actuaries often assume:

→ An expected lifespan of around 83 to 85

→ With a wide distribution around that average

From the insurer’s perspective:

→ Paying until ~85 is the expected case

→ Paying into the 90s and beyond is the risk

That risk is pooled across thousands of annuity holders — and that risk is exactly what you’re buying protection against.

The Decision Is Ultimately Personal

Actuaries work with averages. You don’t live an average life. A life annuity isn’t a bet that you’ll live long — it’s protection in case you do.

When deciding when to start a life annuity, retirees should consider:

→ Personal health and family longevity

→ Lifestyle and activity levels

→ Existing longevity protection (CPP, OAS, pensions)

→ How much guaranteed income is needed later in life

If you expect:

→ Shorter-than-average lifespan → annuities may feel less attractive

→ Longer-than-average lifespan → annuities become increasingly valuable

Pros and Cons of Life Annuities

Pros | Cons |

|---|---|

Guaranteed income for life | Usually irreversible |

Removes longevity risk | No liquidity once purchased |

Immune to market crashes | Fixed payments lose purchasing power over time |

Simple and predictable | No growth upside |

Complements CPP and OAS | Embedded insurance costs |

How Life Annuities Fit an Investing Journey

Life annuities are not meant to replace investing — they are meant to support it.

A resilient retirement income structure looks like this:

→ CPP & OAS = Inflation-protected lifetime base

→ Pensions = Inflation-protected lifetime base

→ Life annuity = Fixed, guaranteed income floor (skip if you have a good pension)

→ Investment portfolio = Growth, flexibility, inflation hedge

This structure allows:

→ Essential expenses to be covered by guarantees

→ Investments to remain invested longer

→ Less pressure to sell during market downturns

The Retirement Income Floor — One Table That Ties It All Together

This table summarizes how income sources naturally shift throughout retirement, and where a life annuity fits best.

Retirement Income by Life Stage

Retirement Phase | Primary Income Source | Role in the Plan | Key Risk Managed |

|---|---|---|---|

Go-Go Years | Portfolio | Growth, flexibility, lifestyle spending | Market volatility (manageable) |

Slow-Go Years | Portfolio + CPP | Gradual shift toward stability | Sequence risk begins to matter |

No-Go Years | Portfolio + CPP + Life Annuity | Guaranteed income floor for life | Longevity risk, cognitive decline |

Portfolio (All Phases) | Investments | Inflation hedge, discretionary spending | Purchasing power erosion |

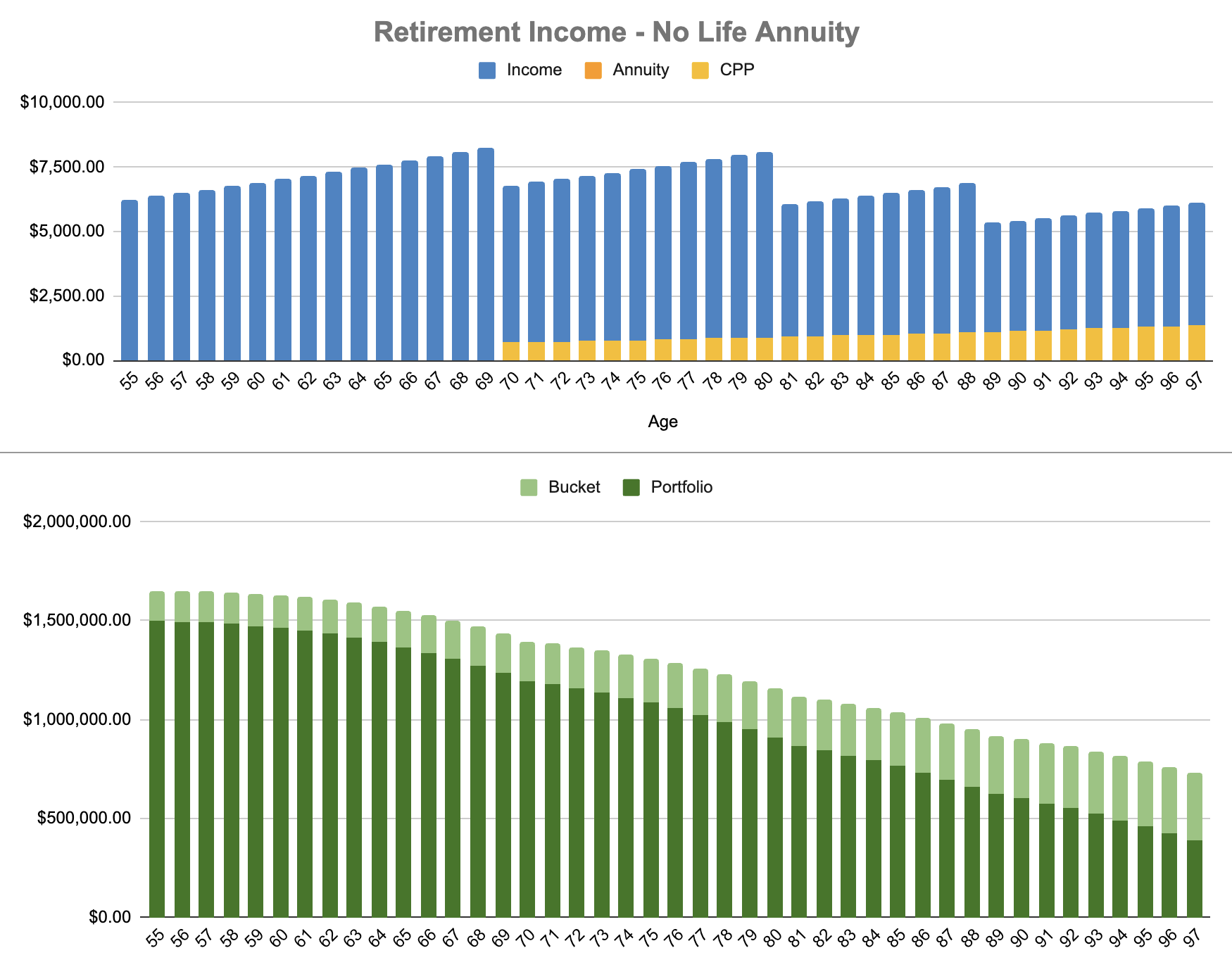

Here are two models with the same retirement numbers, one with a life annuity and the other without.

What you’ll notice from the life annuity model:

→ Higher guaranteed income floor

→ Higher portfolio value

The model uses a bucket strategy with an equity portfolio to provide safety during the bad years. The required monthly income resets at different life stages.

Retirement with Life Annuity

Retirement without Life Annuity

Final Takeaway

Life annuities are not about maximizing returns. They are about eliminating the risk that matters most in retirement.

Used thoughtfully, they allow you to:

→ Lock in a permanent income floor

→ Reduce dependence on markets later in life

→ Build a retirement plan that works no matter how long you live

Think of a life annuity as buying more CPP — with your own savings.