Why Benchmarking Matters Once You Have a Portfolio

When you’re just starting out, benchmarking doesn’t really matter — you don’t have enough invested to compare meaningfully. But once you’ve built a portfolio with real money at work, the question becomes unavoidable:

👉 “Am I doing better by managing this myself, or would I be better off in a simple ETF?”

That’s the heart of benchmarking for DIY investors.

Institutions benchmark portfolios in one way, but for you, the process should be much simpler. Let’s explore both quickly — then we’ll focus on what really matters for DIY investors like you.

Institutional vs DIY Benchmarking

Institutions — pension funds, endowments, mutual funds — benchmark against indices to report to boards and regulators. They:

Set a policy benchmark (e.g., 60% global stocks, 40% bonds).

Track performance against a dynamic benchmark that adjusts for actual weights.

Break down attribution into allocation, selection, and timing.

Compare risk-adjusted returns (Sharpe, information ratio, tracking error).

Assess fund manager(s) performance against the benchmark.

It’s complex, but necessary when billions of dollars, multiple managers, and career accountability are on the line.

DIY investors don’t need that playbook. You’re not reporting to a committee — you just need to know if your approach is better than the next-best alternative you could own.

👉 That means benchmarking against the ETF you’d otherwise buy if you weren’t DIYing.

This way, you’re not benchmarking for the sake of theory — you’re benchmarking to make decisions.

Benchmarking and Your Financial Goals

At the end of the day, benchmarking isn’t only about comparing against an ETF. It’s about knowing whether you’re actually on track to hit your financial goals.

Most of us invest to reach a target value — maybe $1M for retirement, or $500k for early financial independence. Benchmarking your portfolio return against that target tells you whether you’re ahead, on track, or falling behind.

👉 It’s not about bragging rights. It’s about knowing how close you are to your finish line.

The Rule of 72

A simple way to connect returns to goals is the Rule of 72. It tells you how many years it takes for your money to double at a given return:

At 6% annual return, money doubles every 12 years.

At 8% annual return, money doubles every 9 years.

At 10% annual return, money doubles every 7 years.

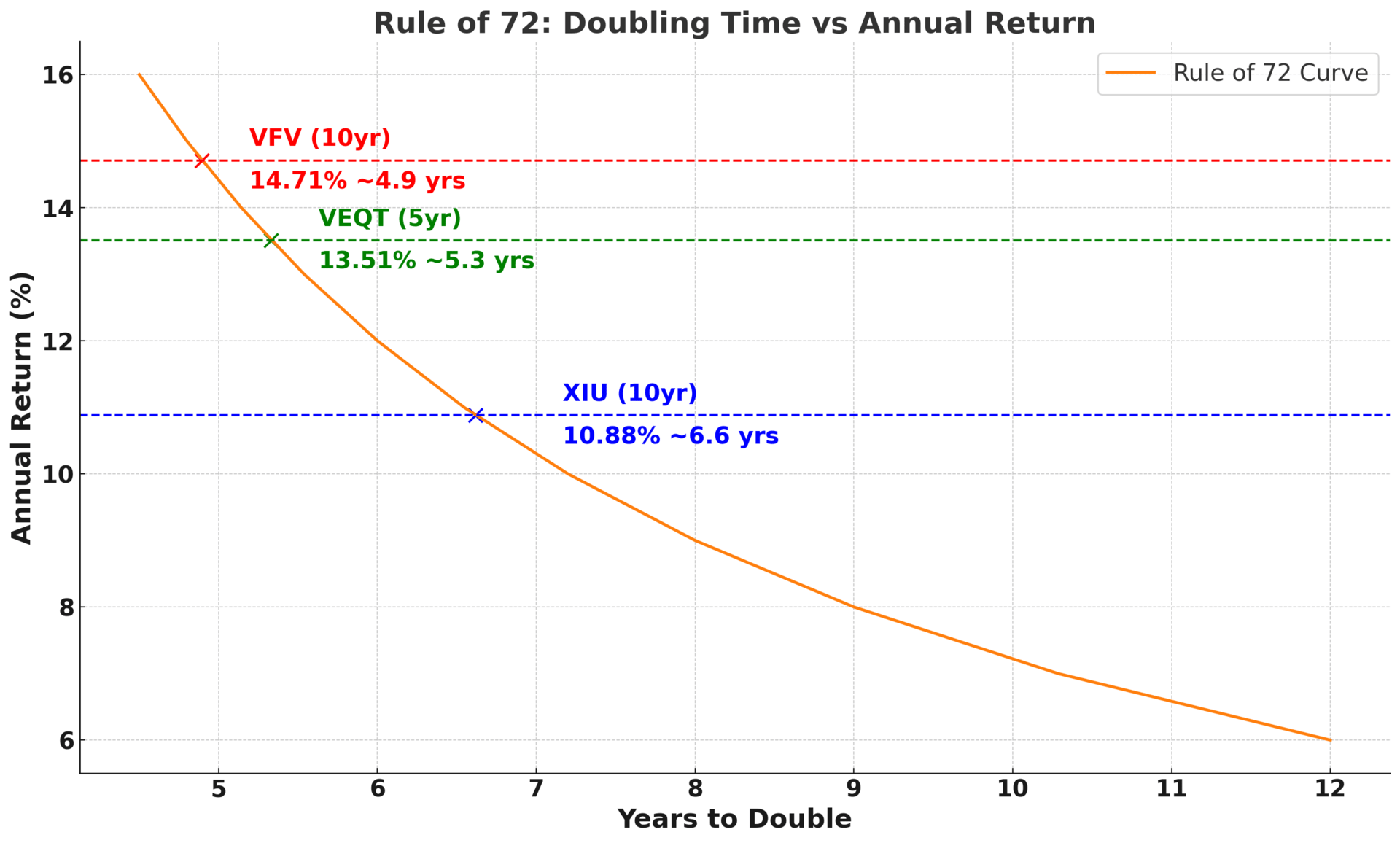

If your retirement target is $1M and you’re at $250k today:

You’ll need to double twice ($250K → $500K → $1M). Depending on your rate of return, your time horizon changes.

Benchmarking your portfolio return vs your target return tells you how many years those doubles will take.

Filling the Gap

If your portfolio grows slower than your benchmark or target return, you can see immediately how many extra years it may take to hit your goal.

If you’re beating your benchmark and compounding faster, you may hit your number years ahead of schedule.

💡 Did You Know?

At 6% returns, $250k takes 24 years to reach $1M. At 10% returns, it takes just 14 years. That’s a full decade saved simply by compounding faster.

Visualizing It: Rule of 72 in Action

Below is the Rule of 72 curve with real ETF benchmarks plotted in:

VFV (S&P 500, 10yr CAGR 14.71%)

XIU (TSX 60, 10yr CAGR 10.88%)

VEQT (All-Equity, 5yr CAGR 13.51%)

Each line shows how long it would take your money to double at those historical rates.

The Investor Types and Their Benchmarks

Every DIY investor falls into one of four broad camps. Once you identify your style, choosing the proper benchmark becomes easy.

📊 Index Investors

You believe in low-cost, broad market exposure. Instead of betting on a handful of companies, you own the whole market through index funds or ETFs. You may already hold VFV (S&P 500), XIU (TSX 60), or an all-in-one solution like VBAL.

For you, the benchmark is straightforward:

The index itself (S&P 500, TSX 60, MSCI ACWI) or

An all-in-one ETF like VBAL, VGRO, or XBAL.

👉 Your goal isn’t to beat the market — it’s to match it with as little cost and effort as possible.

This is very different from 🚀 Growth Investors, who often concentrate their portfolios in the MAG7 (Microsoft, Apple, Google, Amazon, Meta, NVIDIA, Tesla) and maybe a Canadian growth name like Shopify. That concentrated bet can outperform in boom years, but it also comes with much sharper swings when those stocks stumble.

By contrast, index investors are diversified across thousands of companies. The trade-off is simple:

Growth investors: potentially higher returns but with roller-coaster volatility 🎢.

Index investors: steadier, market-matching returns, like a smoother bus ride 🚌.

💡 Did You Know?

Over 90% of active managers underperform their benchmark index over 15 years. Index investors cut out the middleman and own the benchmark directly — no guessing required.

🚀 Growth Investors

You’re after capital appreciation. Instead of just tracking the market, you hand-pick companies with above-average growth prospects — often tech-heavy names like Shopify and the MAG7 (Microsoft, Apple, Google, Amazon, Meta, NVIDIA, Tesla).

The right benchmark for you isn’t the TSX 60 or VBAL. It’s:

The NASDAQ-100 (QQQ or HXQ) for pure tech/growth exposure.

Or a growth index ETF that reflects your sector focus.

Growth investing comes with higher highs and deeper lows. Benchmarking against QQQ or HXQ helps you see if your stock picking actually adds value beyond just holding the growth benchmark.

👉 If your portfolio underperforms QQQ long-term, it means the extra effort and volatility weren’t worth it.

💡 Did You Know?

The MAG7 accounted for over 60% of the S&P 500’s total gains in 2023. Owning them directly feels powerful, but benchmarking against QQQ shows whether your hand-picked bets really added value versus simply holding the broader basket.

💰 Dividend Investors

You focus on companies that pay steady dividends. You want predictable income, but you also expect long-term capital appreciation. You might hold Canadian banks, telecoms, pipelines, and utilities.

Your benchmark isn’t the S&P 500 or VBAL. It’s:

Dividend-focused ETFs like VDY, XDV, or XIU.

These ETFs represent the exact universe of stocks you’re fishing in. Comparing your hand-built dividend portfolio to them shows whether your stock selection, sector tilts, or timing decisions add real value.

👉 If your dividend portfolio performs the same as VDY but takes more time and energy, you’re just replicating the ETF.

💡 Did You Know?

VDY holds only ~50 stocks, and XIU holds just 60. If your dividend portfolio looks similar in holdings, you may already be “benchmark hugging” without realizing it.

🏦 Income Investors

You’ve moved beyond just total return — your main objective is cash flow. You invest in covered call ETFs, REITs, bond ETFs, or preferred shares. For you, distributions matter more than growth.

But here’s the trap: many income strategies generate yield at the cost of capital erosion. That’s why you must benchmark against alternatives like:

ZWB (BMO Covered Call Banks)

ZWC (BMO Covered Call Canadian Banks & Utilities)

ZAG (broad bond ETF)

Benchmarking income portfolios against these helps answer:

👉 Am I truly getting more income, or just adding complexity while taking on more risk?

💡 Did You Know?

Covered call ETFs like ZWB or ZWC often underperform in strong bull markets because they cap upside. Benchmarking income strategies helps you see if you’re trading too much growth for yield.

Beyond Returns: Why Volatility Matters

When most people think about benchmarking, they focus only on returns: “Did my portfolio make more than the ETF?”

But returns alone don’t tell the whole story. You also need to know how rough the ride was getting there. That’s where volatility comes in.

👉 Volatility measures how much your portfolio’s value zigzags up and down over time.

High volatility = bigger ups and downs, like a roller coaster 🎢.

Low volatility = smoother ride, like a calm bus ride 🚌.

Two portfolios can both average 8% a year, but if one has wild swings and the other is steady, the experience — and the stress — are completely different.

That’s why benchmarking isn’t just about comparing performance. It’s about comparing performance + volatility.

💡 Did You Know?

Many investors abandon strategies not because the returns were bad, but because the volatility was too high for their comfort. A smoother benchmark ETF often “wins” simply by keeping investors invested.

Benchmarking Case Studies

Let’s look at three investor types in action. Notice how we’re comparing both performance and volatility — because benchmarking isn’t just about how much you made, it’s also about how bumpy the ride was getting there.

💰 Dividend Investor

Portfolio: $200k in Canadian dividend stocks.

Benchmark: VDY.

5-year CAGR: Portfolio 8.5% vs VDY 7.9%.

Volatility: Portfolio 15% vs VDY 13%.

👉 Both delivered similar returns, but the portfolio zigzagged more along the way. Imagine VDY as a bus on a smooth road 🚌 while your DIY portfolio was a roller coaster 🎢 with steeper climbs and drops.

Takeaway: You outperformed, but was the extra stress and bumpiness worth it?

🚀 Growth Investor

Portfolio: Shopify plus a few of the MAG7 — Microsoft, Apple, Amazon, Meta, NVIDIA, Tesla.

Benchmark: HXQ (NASDAQ ETF).

Performance: In boom years, the MAG7 and Shopify pushed your portfolio far ahead of HXQ. In downturns, HXQ held up slightly better because of broader diversification.

Volatility: Your MAG7-heavy portfolio had extreme swings — huge gains when tech was hot, sharp drops when sentiment turned. HXQ was still volatile, but smoother because it spreads risk across 100 stocks.

👉 This is like comparing the biggest roller coaster in the park 🎢 with dizzying highs and gut-wrenching drops to a smaller coaster that still jolts you, but not as violently.

Takeaway: If you’re all-in on the MAG7, you need to ask whether your extra concentration risk is paying off compared to just holding HXQ or QQQ.

🏦 Income Investor

Portfolio: a mix of covered call ETFs and REITs.

Benchmark: ZWB (covered call banks).

Performance: Both strategies produced strong income.

Volatility: Your DIY mix had wider ups and downs than ZWB.

👉 Here the benchmark is like a steady paycheck 🧾, while your DIY mix is more like freelancing income — sometimes higher, sometimes lower, but less predictable.

Takeaway: If the benchmark gives you the income you want with less zigzagging, why complicate things?

Pitfalls to Avoid

Wrong comparison → Don’t compare dividend stocks to the NASDAQ. Apples vs oranges.

Short-term focus → 1-year performance means little.

Ignoring volatility → Higher returns with higher drawdowns isn’t always better.

Changing benchmarks midstream → That’s just moving the goalposts.

Benchmark hugging → Building a portfolio that looks like XIU while claiming to be “active.”

Conclusion

Institutions benchmark against indices to report to committees and regulators.

DIY investors should benchmark against the ETF or portfolio they’d otherwise hold.

Identify your type — 📊 Index, 🚀 Growth, 💰 Dividend, 🏦 Income — and pick your benchmark accordingly.

👉 The goal isn’t to “beat the market.” It’s to gain clarity: is your DIY effort truly worth it, or would you be better off with the simpler benchmark ETF?

Either way, benchmarking gives you the answer — and that clarity is what builds long-term investing confidence.